Roth conversion calculator fidelity

Non-Roth Solo 401kthe 10000 deferral is treated as pre-tax thereby reducing Ryans income by 10000 to 50000. RMD for Current Year.

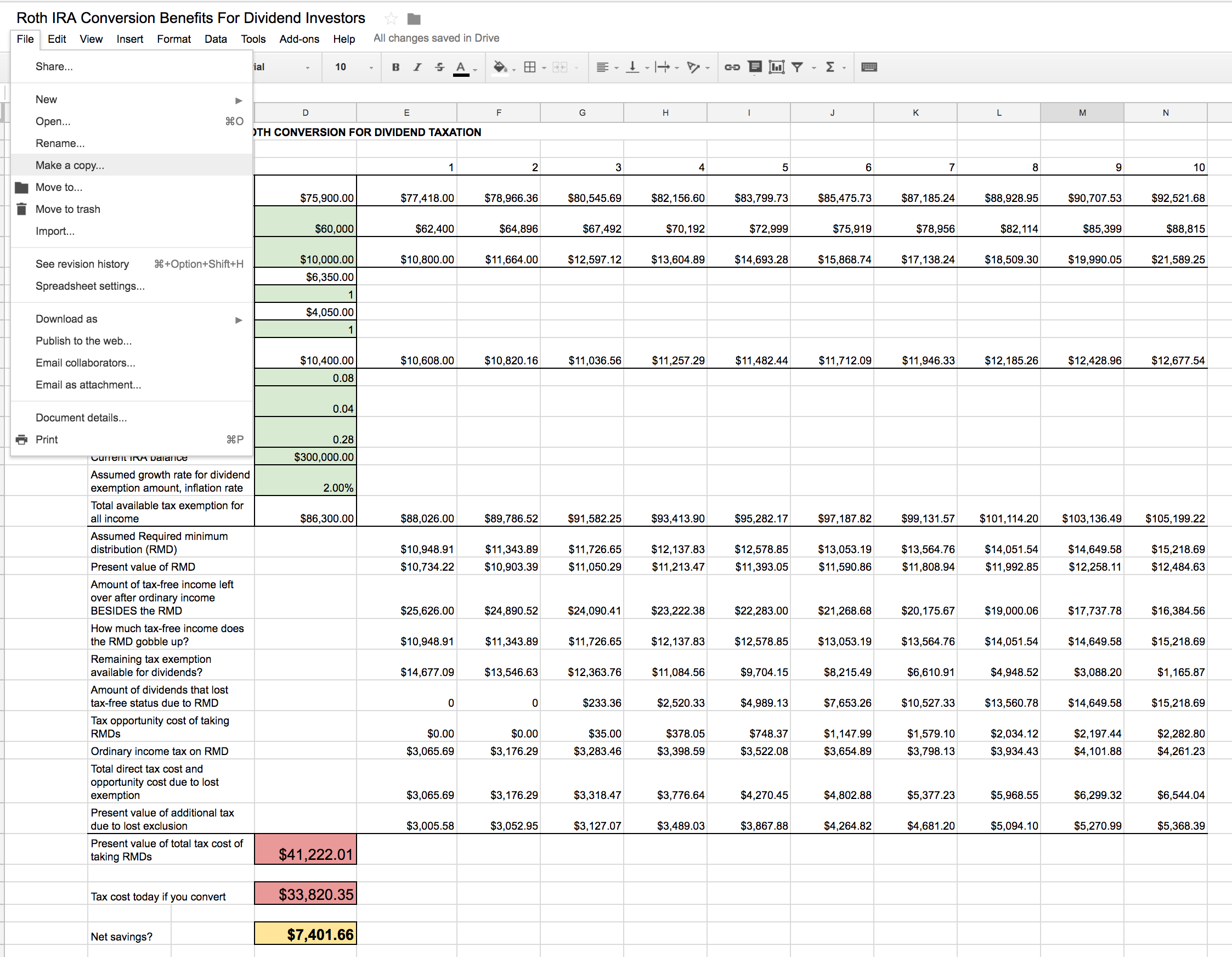

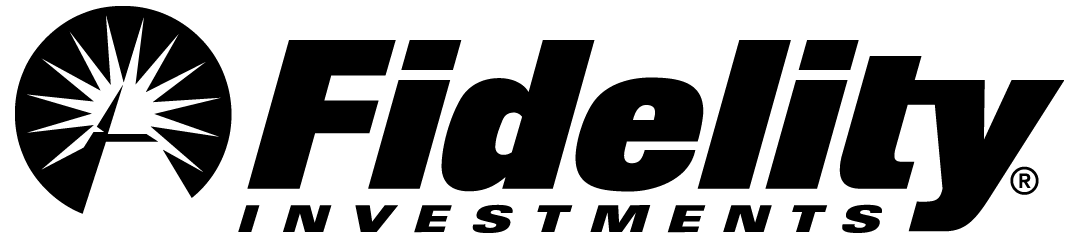

Roth Ira Conversion Spreadsheet Seeking Alpha

Withdrawals of earnings are also tax-free if you are disabled you inherited the Roth or you use the distribution to buy or rebuild a first home.

. Note also if you have assets in a Designated Roth Account ie Roth 401k and would like to roll these to an IRA the assets must be rolled into a Roth IRA. However you may consider 2 options. Any funds that are considered income when you convert to a Roth IRA incur a 10 penalty tax if you withdraw them less than five years after the conversion.

Converting to a Roth IRA may ultimately help you save money on income taxes. Eligible Fidelity account with 50 or more. For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account.

A Roth conversion will trigger taxes so you must be willing and able to pay those taxes. Money is available At any time up until 1231 of the tenth year after the year in which the account holder died at which point all assets need to be fully distributed. It is as if Ryan only made 50000 a year because he is only required to pay taxes on 50000.

The 401k limits and IRA limits are determined based on inflation but can only increase in 500 increments. Not all employers offer in-plan conversions and even when they do a Roth 401k lacks a. Its time to adjust your contributions if you havent already.

A backdoor Roth IRA is a type of conversion that allows people with high incomes to fund a Roth despite IRS income limits. The assets are transferred into an Inherited Roth IRA held in your name. Use code FIDELITY100.

Roth Solo 401k The facts are the same as above except that Ryan chooses to treat the 10000 deferral as a Roth contribution. Contribute to your companys Roth 401k if offered by your employer or do an in-plan conversion to a Roth 401k. The 2019 social security wage base increased by.

Where Fidelity falls short Higher fees for some of the mutual funds. The 2019 Roth IRA limits increased by 500 this year. The Roth 401k contribution limits also increased by 500.

Higher pricing with robo advisor competitors. The Mega Backdoor Roth 401k is one of the best employee benefits available to Microsoft employees. Roth IRAs are similar to traditional IRAs but are taxed differently.

Traditional 401k Solo 401k Analysis. As with Traditional IRA conversions to Roth IRAs if you are required to take an RMD in the year you roll over into an IRA you must take it before rolling over your assets. These changes will offer you increased flexibility and greater convenience when managing your retirement plan accounts at Fidelity andor TIAA.

401k Spend it or Save It Calculator. Of all the mutual funds available for investing in Fidelity Roth IRA only 4 of these funds have zero-commissions. This video explains how the Microsoft Mega Backdoor Roth Conversion works and highlights whats new in.

If youre less than five years away from retirement it probably wont make sense to convert to a Roth IRA. The changes to investment fund choices were the result of an 8-month review of the current 200 investment choices allowed in the University of Nebraskas retirement savings plans. We want to help you understand how this benefit can help you invest more towards retirement and reduce some of your future tax liabilities.

The accounts are funded with after-tax dollars and so do not offer the upfront tax break of a 401k or traditional IRA. However all other mutual funds attract a 4995 fee per trade. A Roth conversion is when you transfer funds from a traditional IRA pension or defined contribution retirement account into a Roth account.

Converting Ira To Roth Ira Fidelity

Roth Ira Conversions When Why And How To Convert A Traditional Ira To A Roth Ira Seeking Alpha

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

How Do I Make Request To Lower Options Commission For My Account R Fidelityinvestments

2

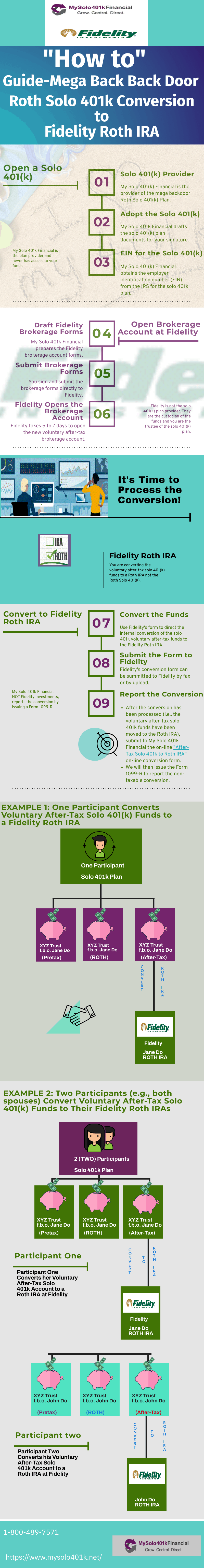

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

How Do I Make Request To Lower Options Commission For My Account R Fidelityinvestments

Vanguard Vs Fidelity Which Ira Is Right For You

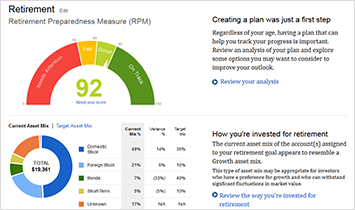

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Traditional Vs Roth Ira Calculator

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

Roth Conversion Calculator Fidelity Investments

Roth Ira Conversion Spreadsheet Seeking Alpha

Traditional Vs Roth Ira Calculator

Converting Ira To Roth Ira Fidelity

Listing Of All Tools Calculators Fidelity